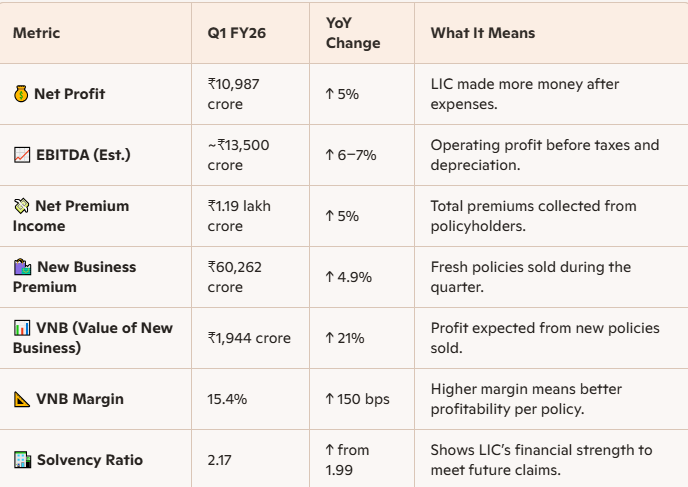

LIC Q1 Results: Life Insurance Corporation of India (LICI) is India’s largest life insurer, commanding over 60% market share in the insurance sector. Net profit rose 5% YoY to ₹10,987 crore, while net premium income grew 5% to ₹1.19 lakh crore. The insurer retained its market leadership with a 63.51% share in First Year Premium Income, and VNB jumped 21% YoY to ₹1,944 crore, indicating stronger profitability.

LIC Q1 FY26 Results Overview

- Net Profit: ₹10,987 crore (↑5% YoY)

- Net Premium Income: ₹1.19 lakh crore (↑5% YoY)

- Assets Under Management (AUM): ₹57.05 lakh crore (↑6.47%)

- Value of New Business (VNB): ₹1,944 crore (↑21%)

- New Business Premium (NBP): ₹60,262 crore (↑4.9% YoY)

Key Announcements & Strategic Shifts

-

LIC will continue to push for product diversification, especially in high-margin non-par plans.

-

Focus on digital sales channels to capture younger customer segments.

-

Management hinted at further cost-optimisation measures to sustain margins.

Retail Investors Should Take Away

Positives:

- Stable Profit Growth: LIC continues to deliver consistent earnings.

- Improved Margins: Shift to non-par products boosts profitability.

- Strong Solvency & AUM: Financial strength remains robust.

- Attractive Valuation: P/E ratio around 11.7 is considered undervalued by analysts

Risks:

- Embedded Value Decline: Indicates potential erosion in long-term value

- Retail Growth Lagging: Group business is driving growth; retail segment needs revival.

Digital Lag: LIC’s tech adoption trails private peers, especially in rural markets

Read more