Medistep Healthcare Limited is a pharmaceutical company engaged in the trading of pharmaceutical, intimate care and hygiene, surgical, and nutraceutical products, along with the manufacturing of intimate care and nutraceutical items. In January 2024, the company began manufacturing sanitary pads and energy powder. The company’s manufacturing unit is located at Kheda, Gujarat.

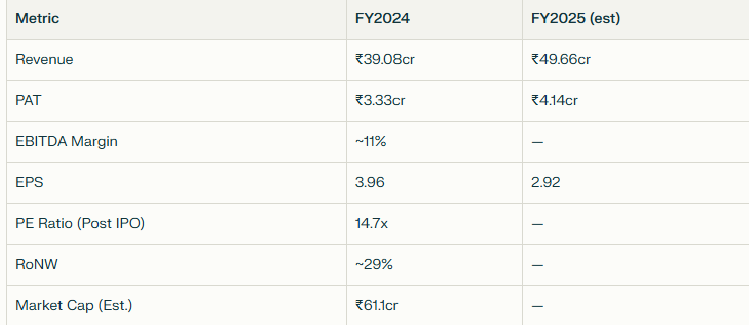

Financials Overview:

Opinions & Strategic Insights

Positives

-

Strong Financial Growth: FY25 revenue ₹49.7 crore, PAT ₹4.14 crore

-

Diversified Product Portfolio: Sanitary pads, nutraceuticals, surgical & intimate care products

-

Post-COVID Hygiene Demand: Rising awareness in Tier 2–4 towns could fuel long-term growth

-

Low Debt: Debt-to-equity ratio of 0.03; strong ROE (29%) and ROCE (38.9%)

Risks & Cautions

-

Thin Liquidity Post-Listing: SME stocks often face wide bid-ask spreads

-

High Entry Barrier for Retail: ₹2.58 lakh minimum investment may deter small-ticket investors

-

Valuation Concerns: P/E ratio ~14x is fair but not cheap; sustainability of profit growth questione

Medistep Healthcare IPO: Snapshot

| Attribute | Details |

|---|---|

| IPO Type | SME Fixed Price Issue |

| Issue Size | ₹16.10 crore |

| Price per Share | ₹43 |

| Lot Size | 3,000 shares |

| Minimum Investment (Retail) | ₹2,58,000 (2 lots = 6,000 shares) |

| IPO Dates | Aug 8–12, 2025 |

| Listing Date | Aug 18, 2025 |

| Exchange | NSE Emerge (SME platform) |

| Lead Manager | Fast Track Finsec Pvt Ltd |

| Registrar | Cameo Corporate Services |

Summary

- Short-term listing gains are probable but not guaranteed.

- High-risk profile: Only allocate what you can afford to lose.

- Long-term buy only after further proof of scale/margin improvement.