Waaree Energies’ Q1 results signal strong operational performance and growth potential, which retail investors interested in renewable energy and solar manufacturing might find attractive given their risk appetite and investment horizon.

Q1 FY26 Financial Highlights

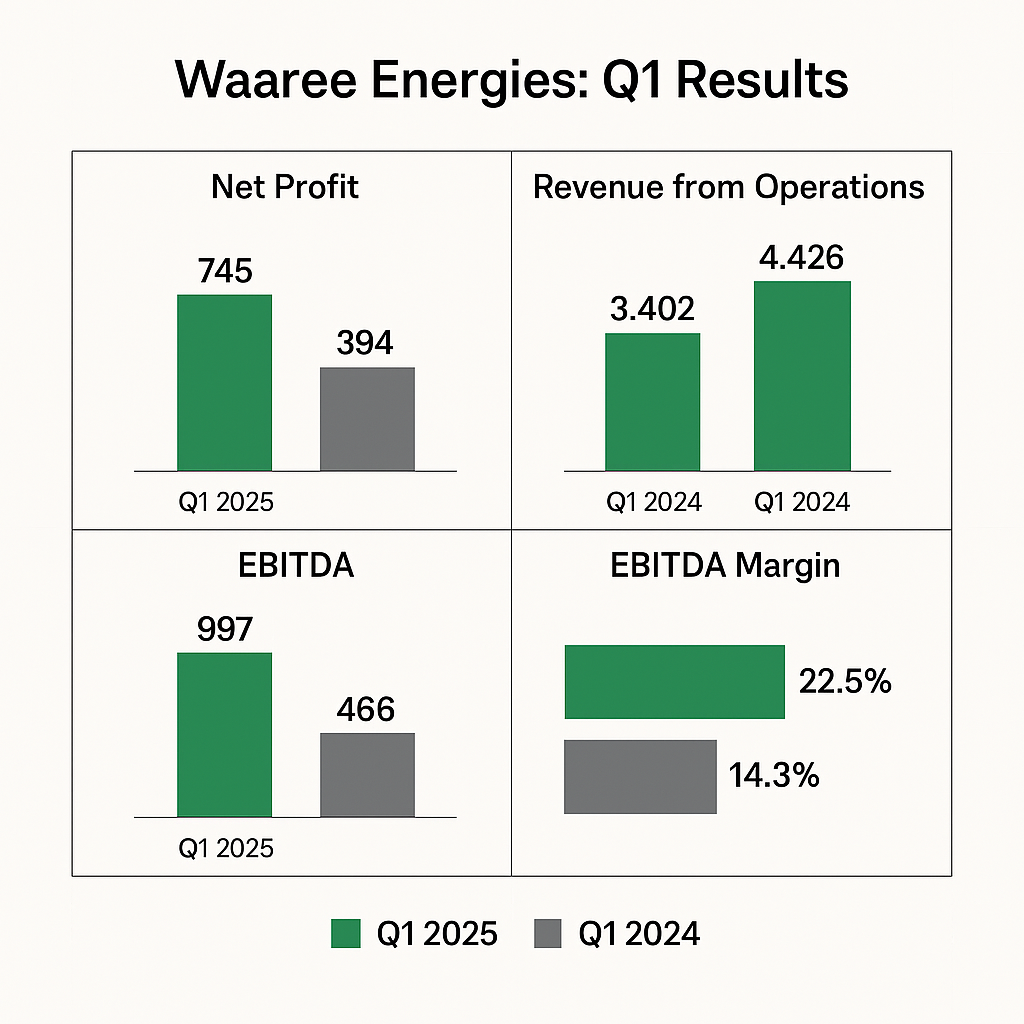

- Net Profit: ₹745 crore, up 89% YoY

- Revenue from Operations: ₹4,426 crore, up 30% YoY

- EBITDA: ₹997 crore, up 73% QoQ; margin improved to 22.5% from 14.3%

- Module Production: Record 2.3 GW, highest ever

- Capex Announcement: ₹2,754 crore to expand cell and ingot-wafer capacity by 4 GW each in Gujarat and Maharashtra

Key Announcements:

- Acquisition of Voltshift Energy Transition Pvt Ltd to consolidate operations

- Strong order book of ₹49,000 crore and global pipeline of 100+ GW

- FY26 EBITDA guidance reaffirmed at ₹5,500–₹6,000 cror

Retail Investor Takeaways

Strong fundamentals: Consistent growth in profit, revenue, and margins signals operational strength

Capex = future growth: Expansion plans suggest long-term scalability and market leadership.

Stock movement: Despite stellar results, shares dipped ~3%—likely due to profit booking after a 50% rally since April

Watch for volatility: Retailers should monitor execution of capex and global demand trends, especially in the US and Europe.

Analysts likely view the results positively due to robust profit growth, increased revenues, and strong EBITDA margin expansion. The large capex approval suggests confidence in future capacity and market demand.

P&L till date : https://www.screener.in/company/WAAREEENER/consolidated/#profit-loss

About Waaree Energies: Company Overview