Asian Paints Q1 FY26 saw better-than-expected volume growth, meeting profit estimates, but revenue and net profits declined due to ongoing price competition and higher costs. Analysts are cautiously optimistic, citing both stabilization in core business and continued risks from rising competition and flat consumer spending. Retailers should appreciate the improvement in volumes but remain alert to changing market dynamics and price pressure

Q1 FY26 Financial Overview

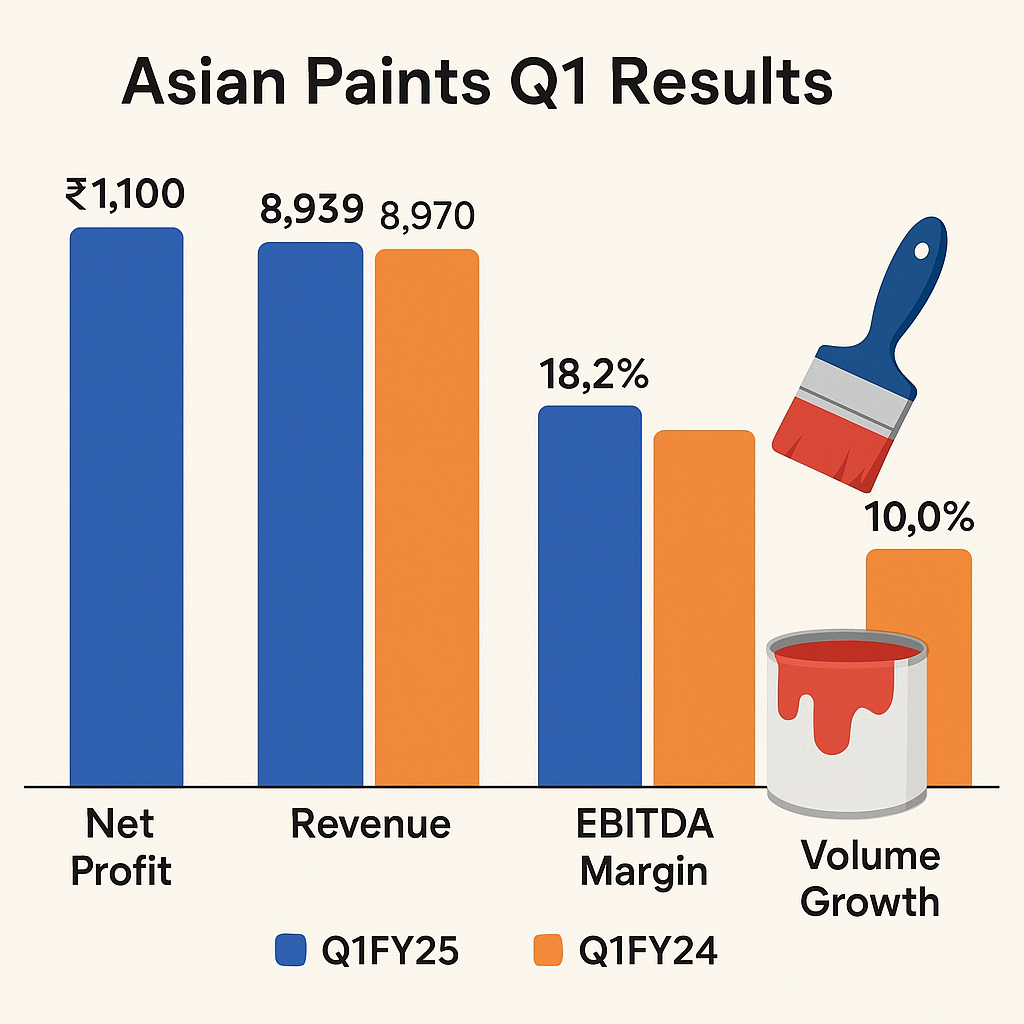

- Net Profit: ₹1,100 crore, down 6% YoY

- Revenue: ₹8,939 crore, marginally down from ₹8,970 crore YoY

- EBITDA Margin: 18.2%, down 70 bps YoY

- Volume Growth (Domestic Decorative): 3.9%, better than previous quarters

- International Business: Value growth of 8.4%, led by UAE, Egypt, and Asian markets

Retailer Takeaways

- Demand Trends: Urban demand showed slight improvement; rural demand recovering faster.

- Pricing Strategy: Price cuts helped revive demand amid competition from Grasim’s Birla Opus

- Retail Chain Performance: Beautiful Homes Stores performed well despite subdued home décor demand

- Consumer Sentiment: Pressure on household disposable income affected premium categories

CEO Comments: Management remains confident about the medium- to long-term prospects in both paint and home décor sectors. They highlight “innovation, brand strength, and retail reach” as focus points to weather competitive challenges

Retail Expansion: Touchpoints increased to 1.65 lakh, strengthening distribution

White Teak Acquisition: Now a wholly owned subsidiary, expanding luxury lighting portfolio

NeoBharat Latex Paint: New launch targeting bottom-of-pyramid consumers, endorsed by Virat Kohli

Analyst Insights

| Analyst | Sentiment |

| JPMorgan | Bearish |

| Macquarie | Bullish |

| IIFL Capital | Neutral to Bearish |

| Geojit Financial | Positive Surprise |

YOY Profit And Loss: https://www.screener.in/company/ASIANPAINT/consolidated/#profit-loss