BEL’s Q1 FY26 performance reflects healthy growth, operational strength, and a robust order pipeline, making it an attractive consideration for retail investors with a medium to long-term investment horizon focused on defense and electronics sectors.

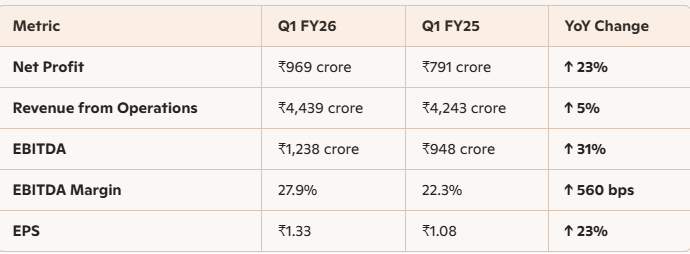

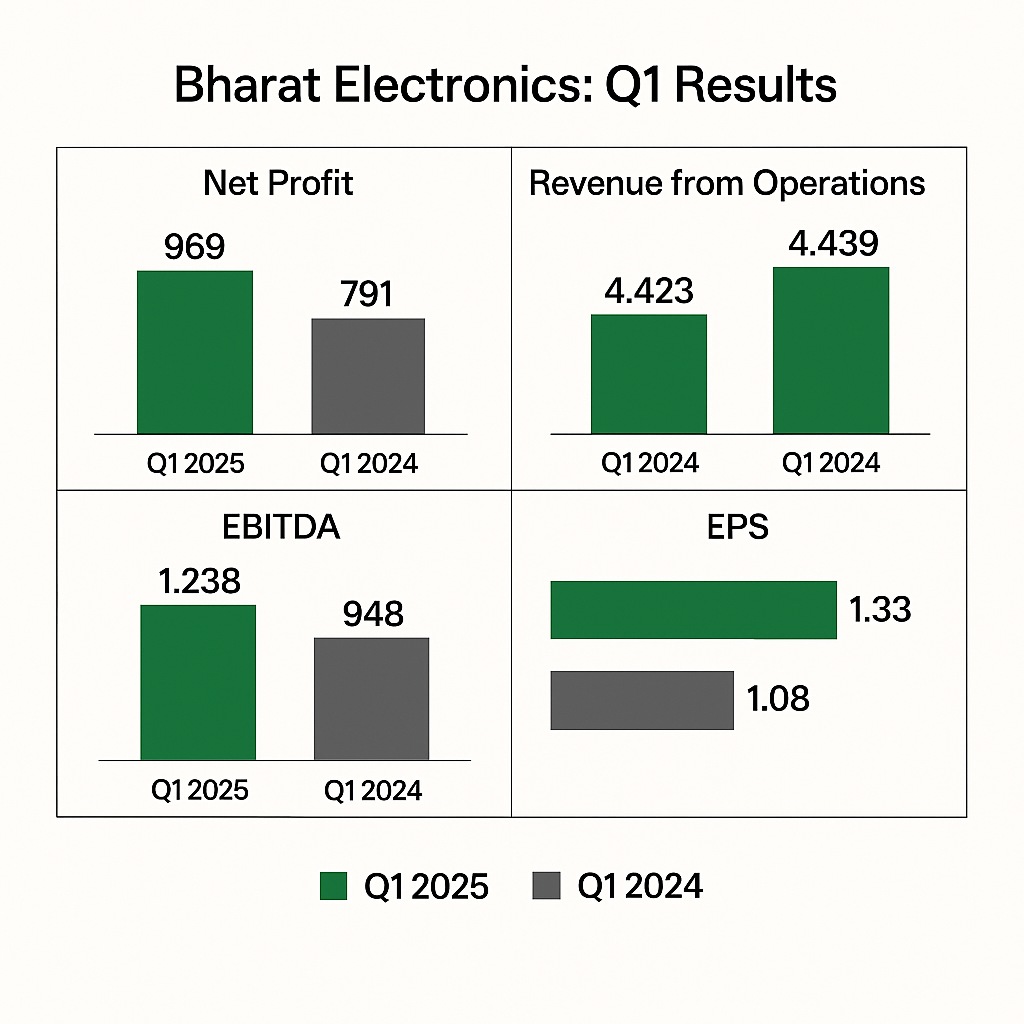

Q1 FY26 Financial Highlights

Key Announcements

Order Book: ₹74,859 crore as of July 1, 2025

New Orders in Q1: ₹7,348 crore (27% of FY26 target)

Strategic Wins: ₹2,000 crore air defence radar contract with 70% indigenous content

Dividend Update: Final dividend of ₹0.90/share for FY25 (total payout ₹2.40/share)

Retail Investor Takeaways

- Strong Fundamentals: BEL continues to deliver consistent profit and margin growth, even in a seasonally weak quarter

- Valuation Watch: Stock trades at ~55x PE; recent dip (~3%) may offer entry point for long-term investors

- Growth Visibility: ₹1 lakh crore pipeline over 18–24 months, including QRSAM and Project Kusha

- Dividend Yield: ~0.6%—not high, but consistent payouts signal stability

P&L Till Date : https://www.screener.in/company/BEL/consolidated/#profit-loss