Bitcoin in India is legal to buy, sell, hold, and trade, but it is not recognized as legal tender, meaning it cannot be used as official currency for payments.

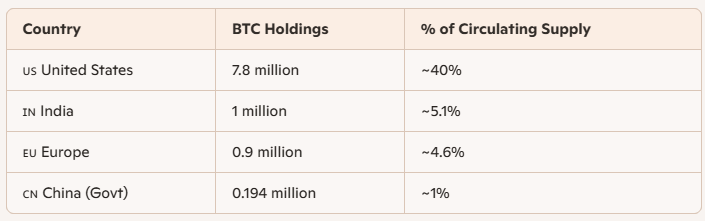

Despite heavy taxation and limited institutional participation, India’s grassroots adoption has surged. Over 90 million Indians now hold crypto assets, with Bitcoin leading the pack.

- India’s rise reflects a massive shift in digital asset adoption, especially among young, tech-savvy investors.

- Analysts believe India could surpass the U.S. in Bitcoin ownership if regulations become more supportive

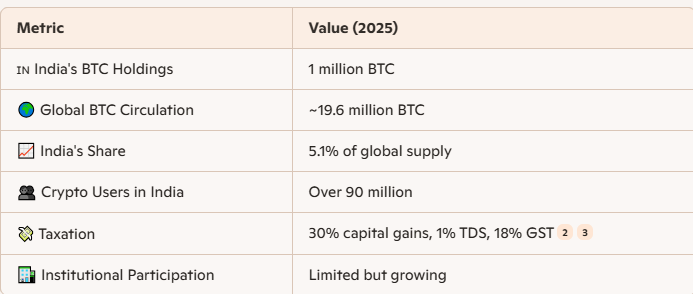

Taxation Structure in India

| Tax Type | Rate | Applies To |

| Income Tax | 30% | On crypto profits (no loss offset) |

| Cess | 4% | On top of income tax |

| TDS | 1% | On sale value |

| GST | 18% | On exchange/platform services |

Example:

Let’s say you bought Bitcoin for ₹50,000 and sold it for ₹80,000:

- Profit: ₹30,000

- Tax: ₹9,000 (30%)

- Cess: ₹360 (4%)

- TDS: ₹800 (1% of ₹80,000)

- GST: If done via exchange, 18% on platform fees

Expert View:

- Aditya Raghavan predicts Bitcoin could hit ₹50 lakh to ₹1 crore by year-end

- Citibank forecasts BTC reaching ₹75 lakh–₹1 crore in India by late 2025

- Sumit Gupta (CoinDCX): “India’s crypto potential is massive. We just need friendlier policies