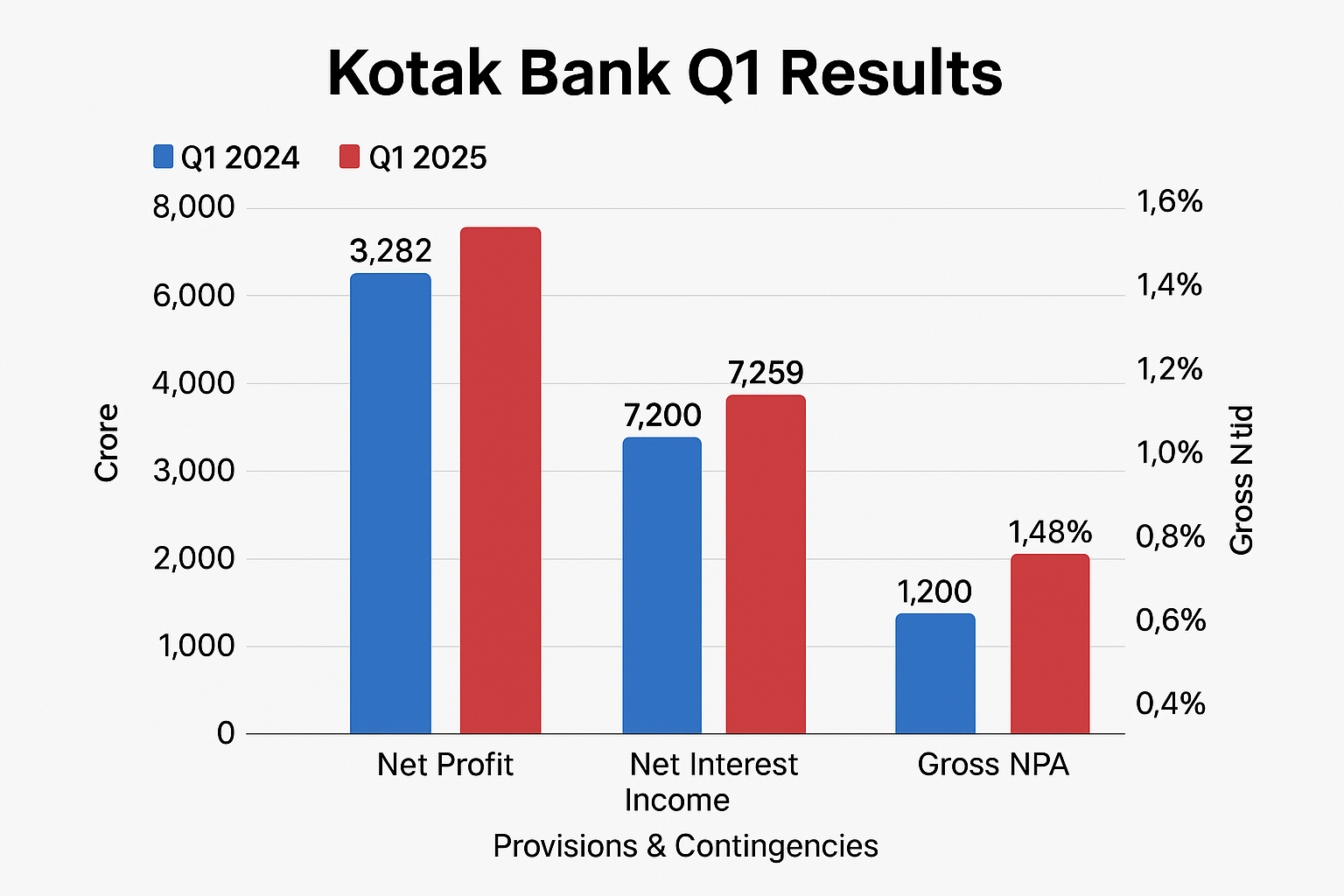

Kotak Mahindra Bank's share price dipped following its Q1 FY26 results, which showed a decline in net profit despite higher net interest income. The drop was partly due to the absence of a one-time gain from its earlier sale of the general insurance business. While both lending and deposits grew, the bank continued to face margin pressure.

Q1 FY26 Financial Overview

- Standalone Net Profit: ₹3,282 crore, down 7% YoY2

- Net Interest Income (NII): ₹7,259 crore, up 6% YoY

- Net Interest Margin (NIM): Compressed to 4.65%, down 37 bps YoY

- Provisions & Contingencies: Shot up 109% YoY to ₹1,208 crore

- Gross NPAs: Increased to 1.48% from 1.39%

- Loan Growth: Healthy 14% YoY, led by corporate segment

Key Announcements & Management Commentary:

- Stress in microfinance (MFI) and retail commercial vehicle (CV) portfolios flagged as major concern

- Management expects NIM to bottom out in Q2, with recovery in H2 due to deposit repricing and CRR benefits

- Disbursements in MFI segment to resume cautiously; CV stress may take 1–2 quarters to normalize

- Focus remains on growing unsecured retail mix to 15% of total book

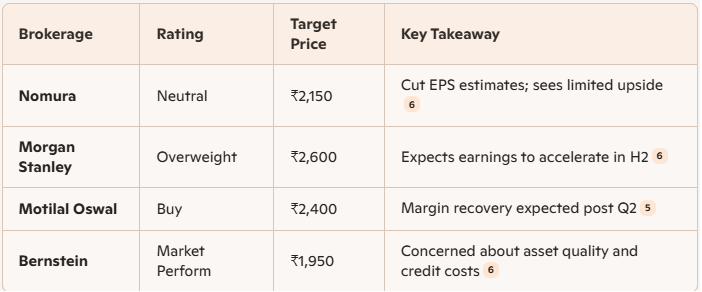

Analyst Findings & Sentiment