Key Findings

- Over-Reliance on Tips & Social Media Gurus : Many traders blindly follow unverified advice from Telegram, YouTube, or Twitter.

- Overtrading & High Transaction Costs :Frequent trades rack up brokerage, STT, GST, and other fees,traders spent 28% more on transaction costs

- Time Decay in Options : Options lose value as expiry nears (Theta decay). Even correct predictions can result in losses.

- Side/Passive Income: Part-time traders juggling jobs often miss key market moves. F&O demands full attention

- F&O demands full attention—split focus leads to poor execution

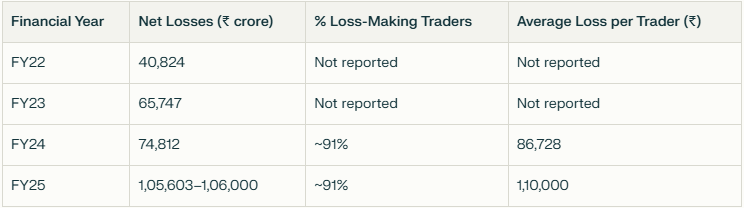

Quantitative Summary: F&O Trader Losses (FY22–FY25)

Retail Traders Can Avoid F&O Losses:

- Avoid Tips, Telegram Channels

Treat F&O as a Business, Not a Side Hustle: Maintain proper books of accounts - Understand the Product Before Trading: Learn how options decay over time

- Risk Management Tools Religiously: Put Stop-losses and avoid averaging

- Never risk more than 5% of capital on a single trade

Despite SEBI’s interventions, retail participation in the F&O segment continues to result in overwhelmingly negative outcomes, with over 91% of traders incurring losses and aggregate losses reaching record highs in FY25

If you have love this article and want to help your Love-ones, Please spread this article to your nearones.

Also Watch