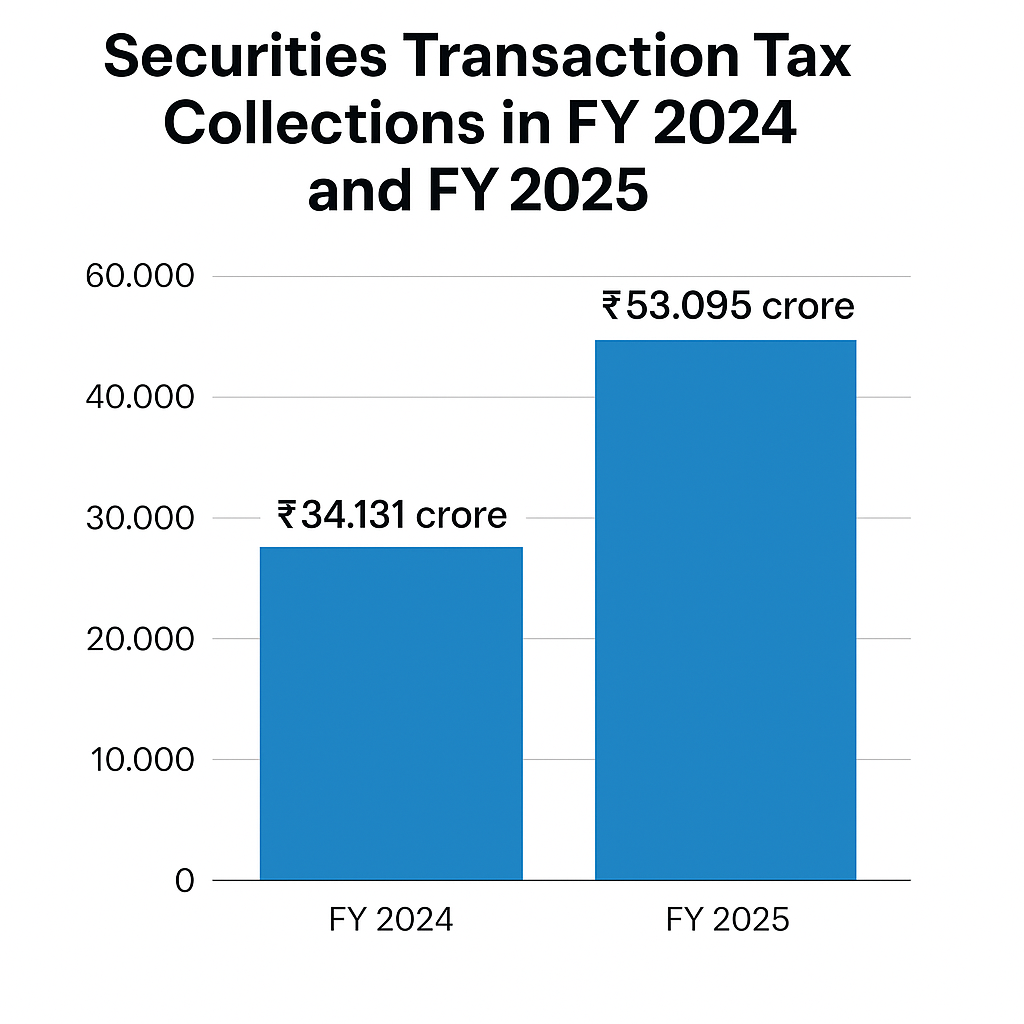

The Indian government earned approximately ₹53,095 crore from Securities Transaction Tax (STT) in the financial year 2024-25, as of March 16, 2025. This figure represents a 55% surge compared to the same period in the previous year, reflecting high trading activity in the stock market during this period. The figure is widely cited in official budget commentary and matches the Central Board of Direct Taxes (CBDT) release for FY25.

Reasons:

- Increased trading activityin equities and derivatives markets.

- A sharp hike in STT rates, especially on futures and options, implemented from October 2024 to curb excessive speculation.

- Despite volatility and regulatory tightening, STT revenue surpassed earlier budget estimates (BE ₹37,000 crore for FY25) by a wide margin.

STT collections over recent years:

- FY25: ₹53,296 crore

- FY24: ₹34,131 crore

- FY23: ₹25,085 crore

Trading volume growth has had a strong, positive influence on the 2025 STT collection, driving record receipts and optimistic budget estimates. The government’s revenue arithmetic for STT is tightly linked to these turnover trends, making STT collections sensitive not just to market direction, but also to regulatory developments and shifts in the composition of trading activity.

The Union Budget 2025-26 projects total STT collections to reach ₹78,000 crore for the full fiscal year (FY25), up from the revised estimate of ₹55,000 crore3. That’s a 40% increase over the revised figure and a 63% jump from the ₹33,778 crore collected in FY24

Also read : Lost the Money in FY 2025: Here are take away for Retail and FNO Traders.