The IT sector has emerged as the worst-performing NSE sector in 2025, and analysts point to a perfect storm of global and structural challenges that have eroded investor confidence and stock valuations.Recovery is likely only after stabilization in external factors and improvement in sector earnings. Investors are advised to remain cautious and monitor for signs of a cyclical bottom. YTD Decline −10% (as of mid-2025)

Reasons Behind the Underperformance

1)Global Macroeconomic Pressure: Slowing growth in the US and Europe—key markets for Indian IT exports—has led to weak client budgets and delayed deal closures

2)FII Outflows: Foreign Institutional Investors have pulled out heavily from IT stocks, citing poor earnings visibility and global uncertainty

3)AI Disruption & Tech Shifts: Rapid changes in tech (especially AI) have disrupted traditional IT service models, making large-cap IT less attractive

4)Valuation Compression: Despite steep corrections, analysts like Citi still find valuations expensive at 24x forward earnings

5)Muted Earnings & Downgrades:Q1 results from major players like TCS and Infosys missed expectations. Morgan Stanley and Citi downgraded several IT stocks

6)Cyclical Nature Emerging: HSBC warns that IT stocks are no longer “buy-and-hold” plays—they now require active management due to increased volatility

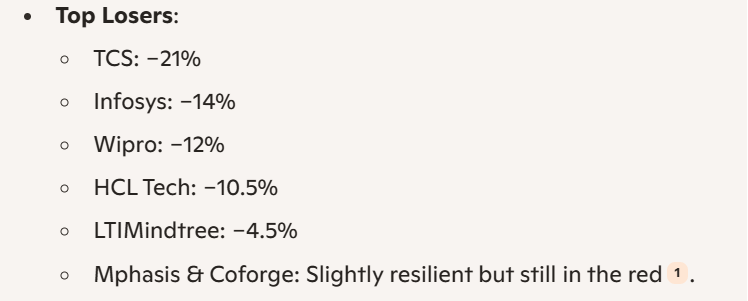

Sector Snapshot:

Analyst Sentiment:

- Morgan Stanley: Sees downside risks to revenue growth and valuation multiples due to macro uncertainty and tech disruption

- Citi: Downgraded several IT stocks, citing expensive valuations and weak US consumption trends. Prefers midcap IT for selective growth

- HSBC: Says large-cap IT stocks are no longer compounding machines; they’ve become cyclical and require tactical investing

Retail Investors Should Note?

- IT is no longer the safe compounder it once was; expect volatility and slower growth

- Midcap IT may offer selective opportunities, but large caps face margin pressure

- Investors should focus on AI-ready, cloud-native firms with diversified revenue streams