One 97 Communications, the parent company of fintech platform Paytm, has reported its first-ever quarterly profit in Q1FY26. The company posted a consolidated net gain of ₹122.5 crore, marking a sharp turnaround from the ₹839 crore loss in the same quarter last year

A Milestone Quarter

- Net Profit stood at ₹122.5 crore, a remarkable turnaround from the ₹839 crore loss reported in the same quarter last year.

- Revenue from operations came in at ₹1,917.5 crore, up 28% year-on-year, signaling robust growth across business segments.

- EBITDA for the quarter reached ₹72 crore, with a margin of 4%, indicating improving cost efficiencies.

- Contribution Margin rose to 60%, an increase of 10 percentage points YoY, driven by optimized expenses and higher profitability per transaction.

- Merchant Subscription Devices hit an all-time high of 1.3 crore, a rise of 21 lakh YoY—highlighting Paytm’s growing footprint among retailers and MSMEs.

Retailer Takeaways

- Merchant Ecosystem Is Booming: With 1.3 crore device subscriptions and 45 million registered merchants, Paytm is doubling down on MSME and enterprise solutions

- AI-Driven Efficiency: Retailers using Paytm’s ecosystem benefit from faster onboarding, fraud detection, and personalized support—all powered by AI

- Loan Distribution Is Growing: Merchant loans are surging, offering retailers better access to working capital

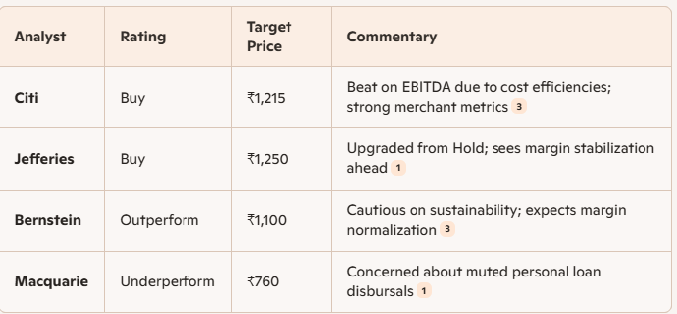

Analyst Reactions