Adani Green Energy’s Q1 FY26 results showcase strong financial performance, rapid operational expansion, and strategic positioning in the renewable energy sector, presenting a compelling case for retail investors eyeing growth in sustainable energy

Key Announcements

- Added 1.6 GW greenfield capacity in Q1 alone; total addition over past year: 4.9 GW

- Developing world’s largest 30 GW RE plant at Khavda, Gujarat

- Reaffirmed target of 50 GW renewable capacity by 2030, including 5 GW hydro pumped storage

- Battery storage flagged as a strategic priority going forward

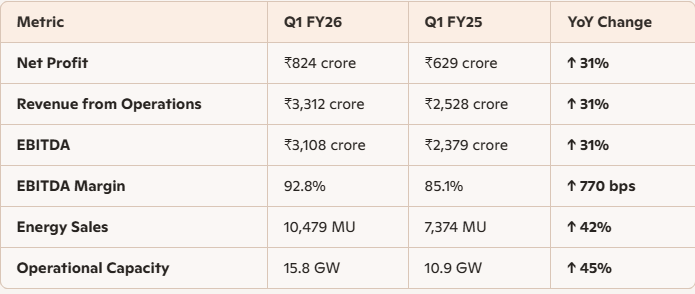

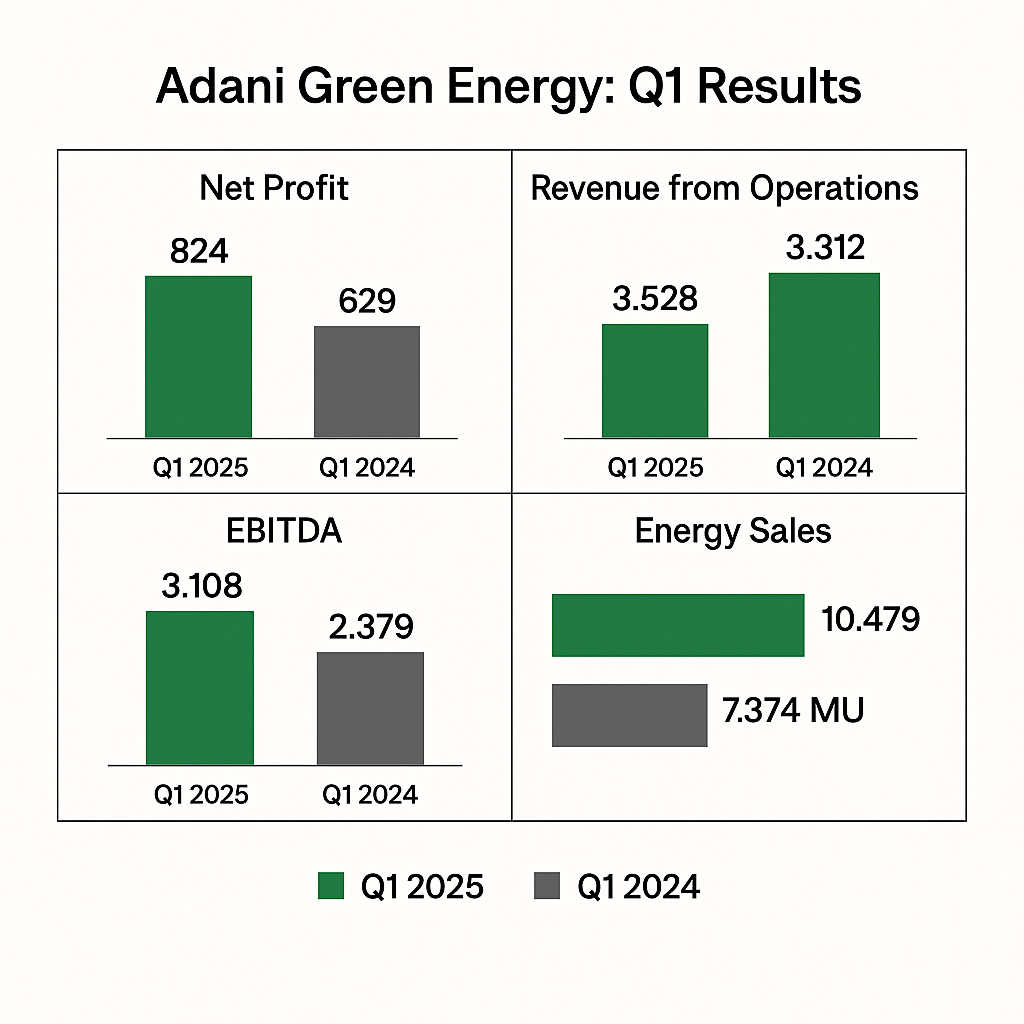

Q1 FY26 Financial Highlights

Retail Investor Takeaways:

•Strong growth story: Consistent YoY gains in profit, revenue, and capacity signal robust execution

•Long-term potential: Aggressive expansion and strategic investments position AGEL as a clean energy leader

•Valuation watch: High PE may limit short-term upside; ideal for long-term conviction holders

•Stock movement: Rose ~3% post-results to ₹1,004.55—momentum supported by earnings beat and future visibility

Analyst Commentary Analysts highlight AGEL's exceptional operational execution with scalable capacity growth and industry-leading margin growth The company’s rapid capacity expansion and strong plant performance underpin its robust revenue and profit growth