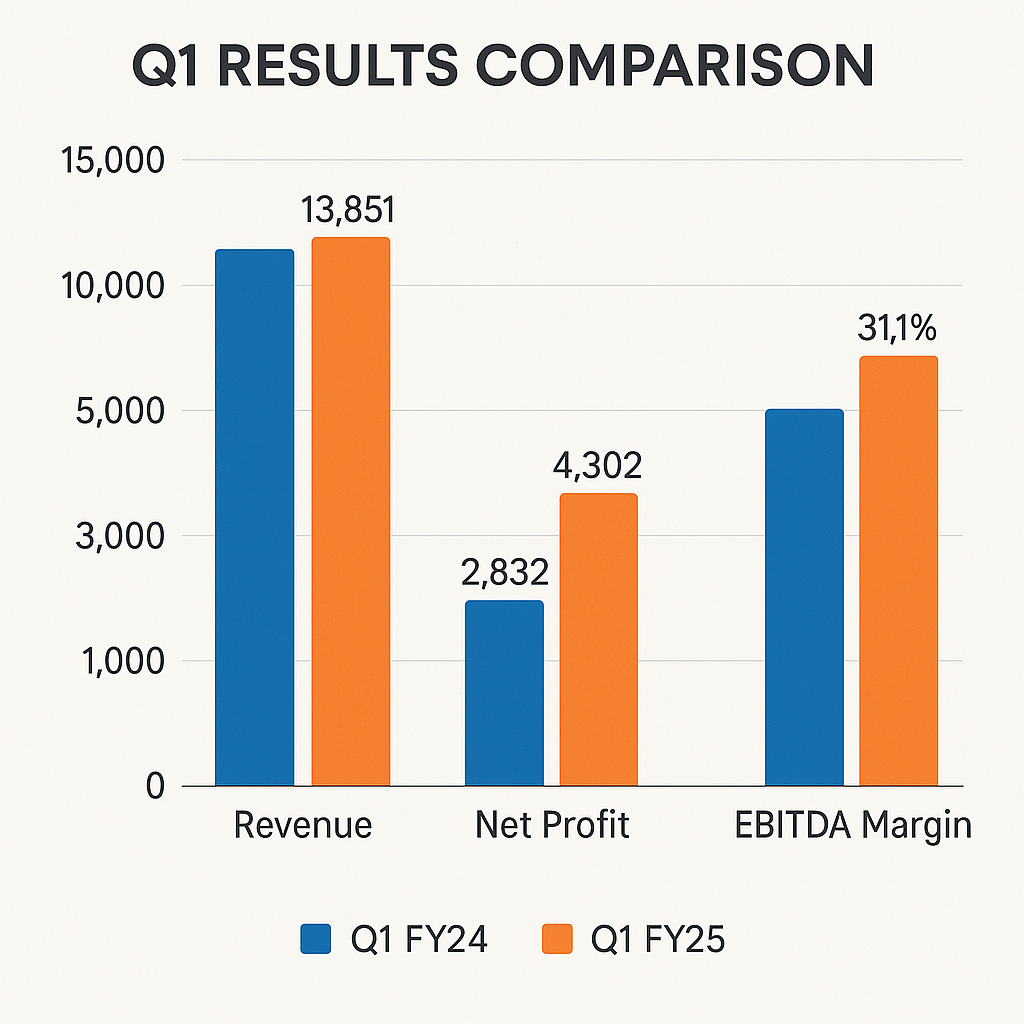

Sun Pharma Q1 FY26 results show revenue up 9.5% year-on-year to ₹13,851 crore, but net profit fell 20% to ₹2,279 crore due to a one-time exceptional charge of ₹818 crore. US formulations and global business delivered steady, though moderate growth. EBITDA up 19.2% with margin improvement to 31.1%

Q1 FY26 Financial Overview

- Revenue: ₹13,851 crore, up 9.5% YoY

- Net Profit: ₹2,278 crore, down 19.6% YoY

- EBITDA: ₹4,302 crore, up 19.2% YoY

- EBITDA Margin: Improved to 31.1% from 28.5%

- India Formulations: ₹4,721 crore, up 13.9%

- US Formulations: $473 million, up 1.4%

- Global Innovative Medicines: $311 million, up 16.9%

Key Announcements

- LEQSELVI Launch in the US: A new treatment for severe alopecia areata, strengthening Sun’s dermatology and innovative portfolio

- 5 New Product Launches in India

- R&D Spend: ₹902.9 crore, 6.5% of sales

- Exceptional Item Impact: ₹818 crore one-time cost dragged down net profit

Retail Investor Takeaways

- Margin pressure in FY26 due to launch costs

- Regulatory clarity on US tariffs

- Performance of new launches like LEQSELVI