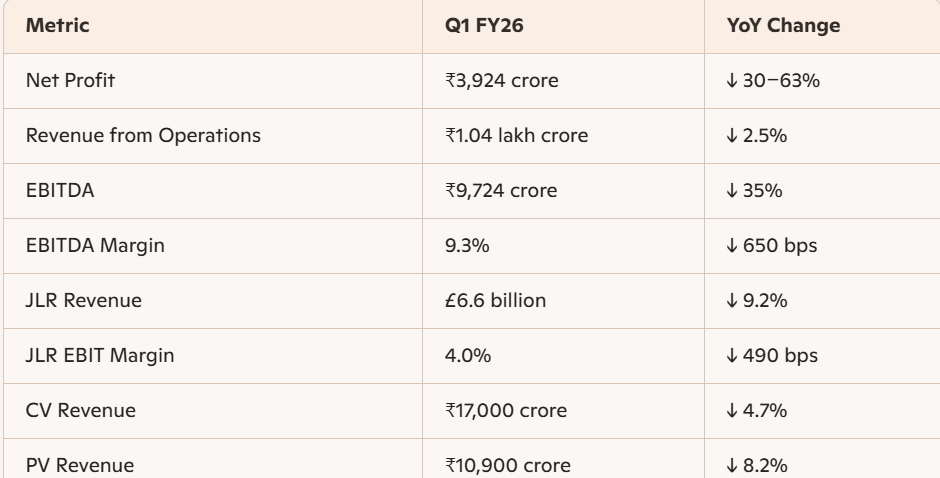

Tata Motors’ Q1 net profit fell 63% year-on-year to ₹3,924 crore, hit by US tariffs, weak demand, and the phase-out of old Jaguar models. Revenue slipped 2.5%, while EBITDA dropped nearly 36%, showing strong pressure on profitability

Results Overview:

Announcements & Strategic Updates:

- Launch of new Harrier and Safari X Persona variants starting at ₹18.99 lakh.

- Highest-ever monthly EV sales in July.

- 100% acquisition (except Defence) of Iveco Group N.V. for €3.80 billion.

- Upcoming demerger in October 2025; focus on restructuring for better segment growth and margin improvement.

Retail Takeaways:

- Short-Term Headwinds: Tariffs, weak volumes, and model transitions are hurting margins, especially at JLR.

- EVs as a Bright Spot: Despite overall PV softness, EV sales showed resilience—this could be a long-term growth lever.

- Demerger & Acquisition: Strategic moves like the demerger and Iveco acquisition signal long-term restructuring and global expansion.

Tata Motors Q1 FY26 vs Q1 FY25 – Financial Comparison:

| Metric | Q1 FY25 | Q1 FY26 |

|---|---|---|

| Revenue | ₹1.07 lakh crore | ₹1.04 lakh crore |

| Net Profit | ₹5,408 crore | ₹3,924 crore |

| EBITDA | ₹14,000 crore | ₹9,724 crore |

| EBITDA Margin | 13.1% | 9.3% |

| JLR Revenue | £7.3 billion | £6.6 billion |

| JLR EBIT Margin | 8.9% | 4.0% |

Tata Motors Q1 FY26 was subdued but the company continues to invest in EVs, new launches, and business restructuring; retail investors should monitor margin improvement programs and look for signs of demand rebound in the ongoing festive and post-demerger periods.

Read Also