Yes Bank’s Q1FY26 net profit surged 59% to Rs 801 crore, driven by lower funding costs and steady asset quality. The 20% stake acquisition by Sumitomo Mitsui Banking Corporation is expected to conclude by September, marking a key milestone in Yes Bank’s growth strategy.

Key Performance Drivers

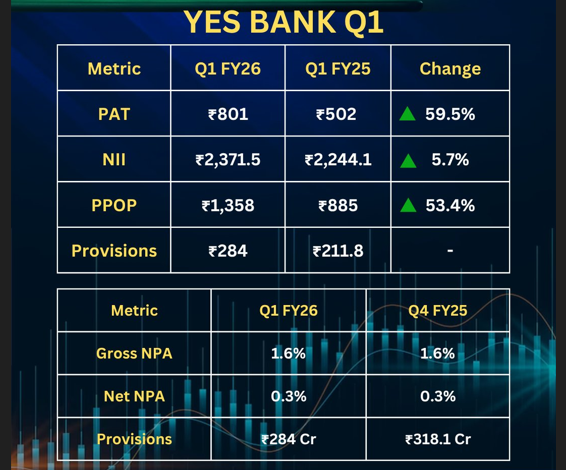

- Net Profit: ₹801 crore, up 59% YoY from ₹502 crore

- Net Interest Income (NII): ₹2,371 crore, up 5.7% YoY

- Total Income: ₹9,348 crore, up 4.8% YoY

- Operating Profit: ₹1,358 crore, up 53.4%

Key Announcements:

Fresh Capital Raise Approved: The board has approved raising ₹10,000 crore via QIP or rights issue to strengthen capital adequacy.

Digital Push: Yes Bank plans to launch a next-gen digital banking platform for MSMEs in FY25

Partnerships Coming Soon: The bank hinted at upcoming partnerships in fintech and lending aggregation.

Financial Data till date of last 6 years https://www.screener.in/company/YESBANK/consolidated/#profit-loss